-

Read more

Present pay-out: how switching bill supplier can help you pay for next Christmas

Price comparison experts at uSwitch, explain how much you could save by simply switching bill supplier and save for Christmas 2020

According to the research, the savings from switching energy supplier could see you save up to £477 – equivalent to x17 Christmas meals for a family of 8 and switching broadband could save £193 – the same as x7 sets of Top Christmas Toy 2019, Bank Attack.

Move over Christmas 2019, building societies are already telling us to start saving for Christmas 2020! With the average household forking out at least £500 on presents and celebrations, according to the Bank of England, it’s a good idea to think about how you can save the pennies without having to cut back on the turkey.

According to uSwitch: “Many people think that saving money literally …

-

Read more

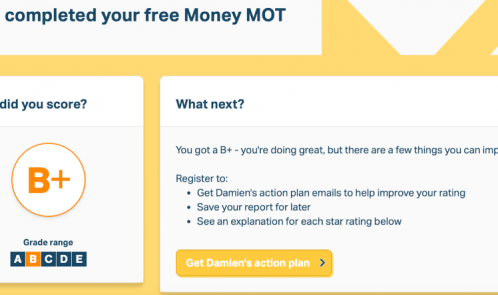

Damien’s Money MOT – free personalised financial guidance

Damien’s Money MOT is a free personalised financial guidance tool, which basically helps to understand your current financial status and then get advice on how to improve it. You don’t give any information like how much you have in your savings accounts etc, but the guidance basically helps you to have a balanced “portfolio” from savings, to life insurance to retirement.

The service is really easy to use and the emails help to remind you of what you need to do or consider.

I have screenshotted the questions so you understand that they are not intrusive.

Its starts with simple questions, age, sex, marital status and number of children and employment status. The first serious question that pops up is do you have a will?

Next we have questions about the size of your estate …

-

Read more

David vs Goliath: can Homebox take on the major comparison giants

On the face of it, major comparison sites provide consumers with all the information they need to quickly determine which company is offering the best value when it comes to utilities like energy and broadband. Here we look at whether these websites really do offer the best deal and if they are all they’re cracked up to be.

Big name providers, such as Confused.com and Compare the Market, only host half the available suppliers, meaning consumers are not being shown the best tariffs available. If we take energy as an example, the average comparison site hosts just 30 suppliers, when there are over 70 operating in the UK.

Comparison site giants give prominence in their search results to firms offering the biggest referral commission, pocketing vast sums of money and misleading consumers in the process …

-

Read more

Top tips on keeping your money safe while at university

Thousands of students will see their bank balance jump to four figures recently as the first instalment of their student loan lands. For many it’s likely to be the most money they’ve ever received so it’s important that they take steps to protect it. Students can easily find themselves a target to fraudsters and already HMRC has warned those beginning a new term to be on the lookout for suspicious emails. Tom Clementson, Director of Consumer at secure payments solution Shieldpay, shares his top tips on how students can keep their money safe.

Thousands of students will see their bank balance jump to four figures recently as the first instalment of their student loan lands. For many it’s likely to be the most money they’ve ever received so it’s important that they take steps to protect it. Students can easily find themselves a target to fraudsters and already HMRC has warned those beginning a new term to be on the lookout for suspicious emails. Tom Clementson, Director of Consumer at secure payments solution Shieldpay, shares his top tips on how students can keep their money safe.

1. Cut down on cards on a night out

You aren’t going to need all your cards with you on a night out. Think about taking cash out or use a top-up card which can be loaded up with how much you… -

Read more

How to save hundreds of pounds on your contact lenses

Did you know that you are not restricted to buying your contact lenses from your optician? Instead, you can buy the same product online for a fraction of the cost and it’s no less safe than buying it from your optician.

How do I get these deals?

Consumers have the legal right to obtain their prescription from their optician, even if you don’t buy lenses from them. Using the contact lens prescription, you can buy the same lenses online.

Finding the right lens

Reputable online contact lens suppliers like Feel God Contacts will have a chart explaining the real names for your own white-labelled brand lenses. This means you can buy the same product but with the manufacturer’s name and packaging and at a cut-price. For example, if you buy lenses from Boots …

-

Read more

How to start a retail-based website on a limited budget

Many of us have nurtured the dream of starting an online retail business from home. If this is the case, why have so few actually followed through to the point when such a vision was ultimately realised?

While there are many answers to this question, one of the most common and seemingly insurmountable involves limited finances. The majority of would-be freelancers are still under the misconception that such ventures require a great deal of money. You will therefore be happy to learn that this is no longer the case. In fact, some have even created highly successful retail websites for the equivalent of what a daily cup of coffee would cost. If you are still somewhat incredulous, this is quite understandable. Let’s take a look at how times have changed as well as why financial …

-

Read more

New pocket money and chores app teaches kids to manage money

Gimi is a new pocket money app and chores manager that has launched in the UK to teach kids as young as six how to earn, save and manage their money.

The app, which is completely free is available on iOS and Android.

Using Gimi parents can:

- Set-up a weekly or monthly allowance for their child

- Set chores for their children to earn additional money (children can also suggest chores to them too!)

- And, create savings. All whilst teaching kids about interest rates

In turn, kids are able to:

- Track the money they’ve earned through good behaviour, jobs completed around the house, goals you set around their school work, anything a parent likes

- Set-up dream buys (such as a skateboard) and monitor how long it takes to get there.

Gimi differs from other pocket …

-

Read more

8 shopping tips for buying bras on a budget

We’ll just cut right to the chase – buying bras can create a gaping hole in your wallet. They’re not the least expensive clothing item, but sometimes, it seems as if we’re left with no other choice, especially when they only last 6 months, and a decent bra costs around £30 for the bigger busted lady.

The good thing in all of this is you don’t have to adhere to market prices all the time. Here are 8 tricks you can do to smartly shop for bras on a budget so your dollar can go further!

1. Check Discount Stores

It helps to pay discount stores and outlets a visit every once in a while. These stores might have perfectly functional bras with no defects at discounted prices. The only thing with these stores is …

-

Read more

What is Hoppy and how can it help you save money?

Hoppy is a new home management site that claims to takes the stress out of the day to day running of your home. The site provides access to a vast array of energy, broadband/tv and mobile deals helping you easily compare each offer and work out which is the best deal for you.

Wanting to find out more, I asked the Hoppy team some questions and think that the service is well worth a try.

Tell us about your tradespeople directory?

The Hoppy site is also home to a large directory of over 1,800 fully vetted tradespeople from decorators to lock smiths. Users can book and pay online for a local tradesperson all backed by a Plentific Guarantee, ensuring you receive the best possible service in your home. The help doesn’t end there as with …

-

Read more

An alternative to Loyalive – free loyalty cards app from Stampuno to access all your shopping cards in one place

Do you have the same problem as me? A handbag or purse with too many plastic and paper loyalty cards in those tiny little pockets – and they can be a real pain to use.

I might often struggle nervously to find the right card when I get to the till or café counter. If I can’t see it (my eyesight isn’t what it used to be), I sometimes give up, because I don’t want to hold up the queue, pay the full price and lose some potential loyalty points.

Never Again Miss Any of Your Loyalty Card Points

I think a loyalty cards app is important for us shoppers. We spend huge amounts of money in shops every month and we deserve to get and use all the loyalty points we have earned.

After …