-

Read more

New pocket money and chores app teaches kids to manage money

Gimi is a new pocket money app and chores manager that has launched in the UK to teach kids as young as six how to earn, save and manage their money.

The app, which is completely free is available on iOS and Android.

Using Gimi parents can:

- Set-up a weekly or monthly allowance for their child

- Set chores for their children to earn additional money (children can also suggest chores to them too!)

- And, create savings. All whilst teaching kids about interest rates

In turn, kids are able to:

- Track the money they’ve earned through good behaviour, jobs completed around the house, goals you set around their school work, anything a parent likes

- Set-up dream buys (such as a skateboard) and monitor how long it takes to get there.

Gimi differs from other pocket …

-

Read more

Have people stopped saving?

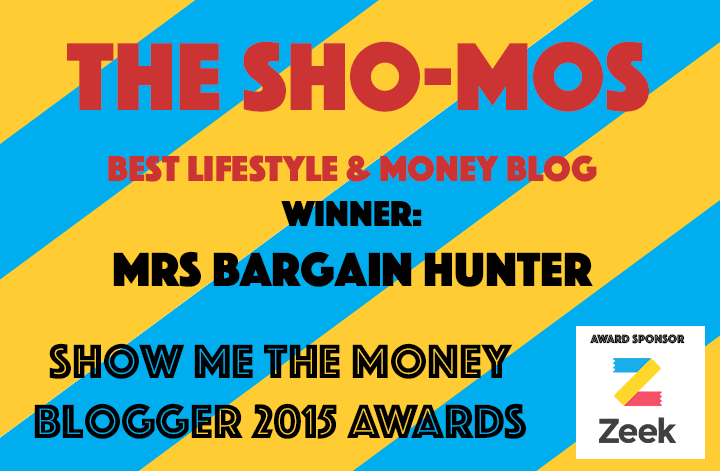

This was the topic of a session at finance bloggers event The Shomos a couple of weeks ago. A panel discussion included a representative from James from Vanguard, Mike from 7 Circles, Mrs Mummypenny, Lynne James and Faith Archer from Much more with Less.

Scarely, 1/4 of adults have less than £100 savings, unlike most money bloggers who have emergency fund, pensions and some have stocks and shares.

The reasons why people are not saving include poor interest rates, the global financial crisis and some debt that needs to be paid off, which takes priority.

The chap from Vanguard tried to offer an alternative, but said that barriers to entry to saving via investing include perceived complexity and the cost of investment. Vanguard offers index trackers and wants to lower the …

-

Read more

Open banking and Yolt

I went to the money saving bloggers event last week and met the team from Yolt, an app that helps consumers to benefit from open banking and aims to change our attitude to money. It’s bank agnostic and provides one view of financials.

Money is the root of all evil, apparently. Unfortunately, most of us in the UK, don’t have savings to cover three month emergency period. Some people don’t have the income to allow them to save, and others are simply not interested in saving.

Sometimes we’re irrational when it comes to money, and don’t really know the true value of products/services we buy. There’s this thing called anchoring you see. It’s used by restaurants for example, where there is a high price of wine or dish, and basically when you see the price, …